Finance

- Pre-Authorized Tax Payment Plan Information

- Tax Information

- Collection of Taxes

- Fee list

- Audited Financial Statements

- Change of Address

- 2019 Energy Plan

- 2020 Energy Report

- Strategic Asset Management Policy

- Asset Management Plan - Final Report

- Treasurer's Statement - Development Charges 2021

- Reserve & Reserve Fund Policy

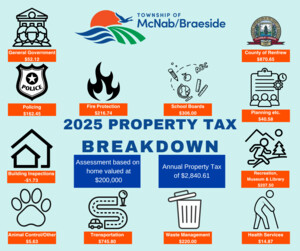

INFORMATION BULLETIN – APRIL 2025

Final Property Tax Notices will be mailed to all Residential, Farm, Managed Forest, Pipeline, Multi-Residential, Commercial and Industrial property owners in July. The final tax levy will be split into the same two installments, due on August 29th 2025 and October 31st 2025.

Audited Financial Statements

2023 Audired Financial Statements 2022 Audited Financial Statements 2021 Audited Financial Statements 2020 Audited Financial Statements 2019 Audited Financial Statements 2018 Audited Financial Statements 2017 Audited Financial...Pre-Authorized Tax Payment Plan

***NEW*** PRE-AUTHORIZED PAYMENT PLAN Paying your taxes by pre-authorized payments means eliminating the chore of writing cheques and ensuring your payment reaches the Township office by the due date. You'll never have to worry about...Tax Information

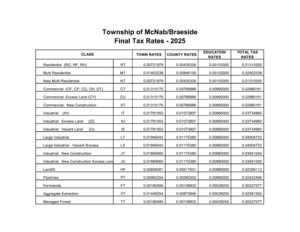

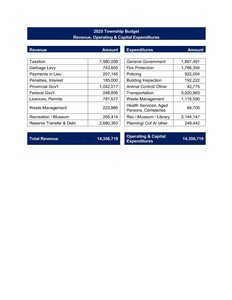

The Township mails two tax bills each year. The first tax bill is the interim tax bill with two instalments due at the end of March and the end of May. The Interim Tax Bill is calculated at 50% of the previous year's total Taxes Levied. The Final Tax Bill is calculated using the current market value assessment times the tax rates less the interim bill amount, and the balance is divided into two instalments due at the end of August and October.

Collection of Taxes

A PENALTY OF 1¼% per month will be added to any outstanding amount on the 1st day of each month until paid. Failure to receive a Tax Bill does not relieve the Taxpayer from payment of Taxes or Penalty. If a property has changed ownership, please return the Tax Bill to the Township Office.